Wells Fargo checking accountsWells Fargo has five different options for personal checking accounts — Everyday, Preferred, Portfolio, Teen and Opportunity. Businesses can select from Simple, Choice Platinum and Analyzed checking accounts. Most personal and business checking accounts require a $25 deposit to open.Wells Fargo savings accounts and CDsWells Fargo offers two savings account options, Way2Save and Platinum Savings.

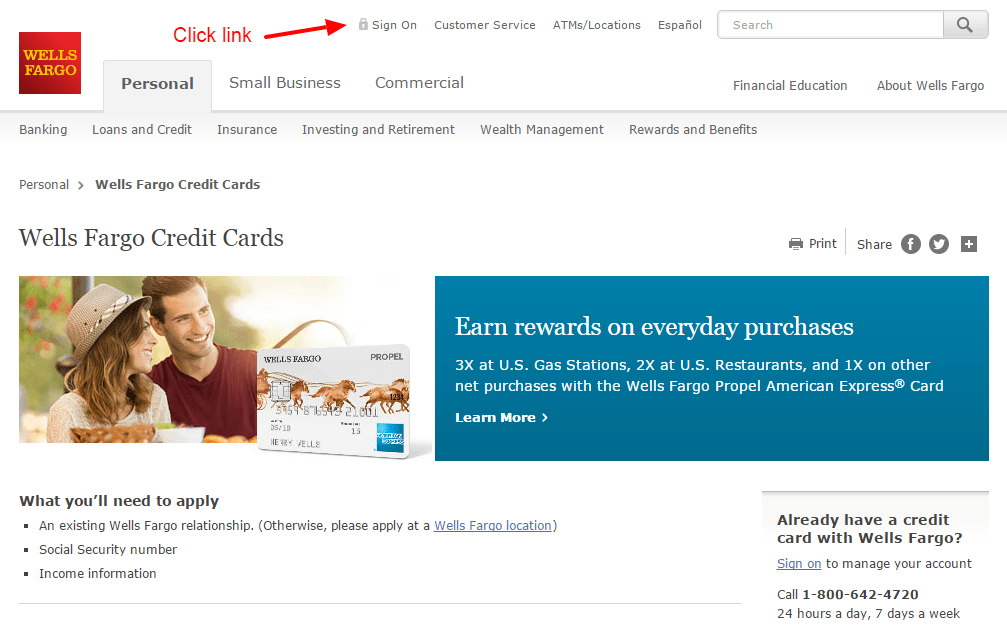

Wells Fargo also offers CDs, which require at least a $2,500 minimum opening deposit. CDs are available at fixed rates and step rates.Wells Fargo loansWells Fargo offers multiple loan types, including student loans, auto loans and mortgage loans to help you buy, refinance or renovate a home. The bank offers low-APR personal loans and lines of credit ranging from $3,000 to $100,000. Wells Fargo also provides loans and lines of credit for businesses.Wells Fargo credit cardsWells Fargo has several credit card options.

Almost all Wells Fargo cards have a cash back or reward program, and a few have no annual fee.Wells Fargo retirement servicesWells Fargo offers traditional and Roth IRAs. You can also invest in mutual funds and manage your portfolio yourself or with the help of a Wells Fargo investment professional. The WellsTrade Mutual Fund Screened Listed makes investing simple by pre-screening mutual funds.

Wells Fargo Advisors, a full-service brokerage, is available to customers to help with investment planning. Mobile payments are available for Apple Pay, Google Pay and Samsung Pay. Wells Fargo benefits for business owners also include Clover point-of-sale systems customized fit your business needs. Wells Fargo's monthly service fees for checking accounts range from $0 to $30, though service fees are waived for teenagers and college students between 17 to 24 years old.

Monthly service fees for business checking accounts range from $10 to $40. The bank charges a $5 or $12 monthly fee on savings accounts. Wells Fargo's checking account fees can be avoided by maintaining a specific average balance or completing a minimum number of transactions each month. Also, expect fees for late credit card payments and overdraft charges unless your checking and savings accounts are linked.

Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®.

The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier's message and data rates may apply.

I recently had to open a business account as the Wells Fargo Branch that I use stopped taking my deposits on my account that had been open since 2006. Therefore my business had good positive cash flow as needed. Well now I am in some cases depending on how things fall out looking at 10 days roughly before I see a deposit cleared for use in my account.

This has now placed my entire business into a negative cash flow operation and is costing me dearly in fees from creditors needing to be paid with the funds that are in deposit hold. You have access to funds from a my deposit days before it gets credited to me and could be using it to make investments for the bank during this time. What a way to have free money to place short term investments using money you don't even allow your customer to have which they entrusted with the keeping of the money deposited. Anyway not sure why the customer gets left holding the bills for what banks are doing with deposits. I am shopping for a local bank that can provide me with more personal services and is willing to work with their local customers whom actually care about their small communities. I guess I should have known that a national bank chain in a small town was a mistake.

I deposited a check on January 24th for 2500 from my husbands usaa account to pay bills. When I deposited it they said the funds would be available on the 25th of January. When I called on the 25th the funds were not in my account and the person I spoke to said that it was because the funds were not in the usaa account. My husband showed me the account and the funds were removed so I called wells fargo back again and this time they told me because of repeated overdrafts on my account in the past 6 months they are holding the money until FEB 4th. I have bills that need to be paid and they come out of my account automatically every month which is why I deposited the check to begin with. They told me there was nothing they could do over the phone and I would have to go in person to the branch where I deposited the check.

So I just went to the branch and told them and they are now saying because I deposited the check in the atm there is nothing they can do. I've been told multiple different things in the past few days and all i'm trying to do is avoid more overdraft fees and pay my bills that NEED to be paid and no one can help me. I've been a customer since 2005 and now all I want to do is close my account. Bills come out of my account automatically every month. I've paid all the overdraft fees and never complained but all this is doing is putting me in the hole again. Not to mention the female that is spoke with at the branch was extremely rude to me.

Can they makes the funds available any way so that my bills can be paid that are coming out this week? They are penalizing me for the previous overdraft fees but all they are doing is causing me to have more. Wells Fargo provides banking, investment and mortgage services as well as commercial and consumer financing at 7,600 locations in 32 countries and territories around the globe. Wells Fargo mobile banking gives customers the ability to link their checking, savings, credit card and investment accounts all in one place. Customers can also deposit checks from their phones with the Wells Fargo app.

When you provide a phone number to us, you agree that you own or are authorized to provide the telephone number to us. To help protect your account security, Wells Fargo does not support SMS or MMS functionality for recognized VoIP, prepaid or landline phone numbers. In order to receive text messages from Wells Fargo, such as one-time passcodes or suspicious activity alerts, an eligible phone number and mobile device are required. Your mobile carrier's message and data rates may apply.

A Funding Account may not be used to pay any part of the balance you owe on that Funding Account. Eligible Accounts that require two or more signatures or authorizations to withdraw or transfer funds may not be used as a Funding Account. A Funding Account must remain linked to the Service in order to use the Funding Account for current, future and automatic Bill Pay payments. If you choose to link your account to your Wells Fargo checking account for Overdraft Protection, please note the following. Depending on your account terms, an Overdraft Protection Advance Fee may be charged to your account each day an Overdraft Protection Advance is made, and interest will accrue from the date each advance is made.

Your credit card must be activated; if it is not activated, no money will transfer to cover the overdraft. Once your credit card has been activated, please allow up to 3 business days for your Overdraft Protection service to be fully enabled. Refer to the Consumer Credit Card Customer Agreement and Disclosure Statement for details. There may be other options available to protect against overdraft that may be less costly. For additional information on Overdraft Protection using your credit card, please visit /credit-cards/features/overdraft-protection. For details on other options, please visit /checking/overdraft-services/.

Wells Fargo closed out my credit card because they believed someone was using my card # to make purchases. So they closed that card # and opened a new card for me transfering the balance over to he new account. The only problem was they did not transfer the payment that I pre-schedule to pay balance. After being on the phone for 45 minutes I final talk to a supervisor who told me that they were going to take care of it .

A couple of days later I called customer service(dis-service) again. Note that these liability rules are established by Regulation E, which implements the federal Electronic Fund Transfer Act and do not apply to business accounts. Our account agreements regarding unauthorized debit card, ATM Card, Wells Fargo EasyPay®, and consumer and business credit card transactions may give you more protection, provided you report the transactions promptly. Please see the agreement you received with your ATM, debit card, Wells Fargo EasyPay, or consumer and business credit cards, and the Eligible Account agreement. Wells Fargo check cashing feeYou only have to pay a Wells Fargo Bank fee to cash a check if you don't have an account.

Outside of the U.S., ATM cash withdrawals are $5 each and ATM accounts transfers are $2 per transfer.Wells Fargo cash advance feeWells Fargo's cash advance fees are up to $12.50 per transaction. Wells Fargo may automatically send you certain alert messages via email, text message, push notification, and/or by other means, including to your mobile device. These messages may include notifications about potential fraud on your accounts, debit card or credit card, recent account activity, or changes to your online profile. You can opt not to receive push notifications by turning off push notifications on your Wells Fargo Mobile app.

If applicable on your account, these monthly fees are in addition to your monthly service fee. 2Enrollment with Zelle through Wells Fargo Online® is required. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle. Available to almost anyone with a U.S.-based bank account.

For your protection, Zelle should only be used for sending money to friends, family, or others you know and trust. Sending money with Zelle is similar to making a payment in cash. The Request feature within Zelle is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement.

I went into Wells Fargo Bank to make a deposit into my sister checking account. I told the teller that I needed to make a cash deposit to her acct. I had her full name, address and phone number if she could get the account # and deposit the funds? She told me she was not allowed to look up information on customers that I needed to give her the number. I asked for the manager and told her that since I am not on the acct. I have no acct#, The manager informed me that she could not accept cash deposits I thought this was a joke.

She said they could take a check or money order, but no cash due to money laundering. She said we have the rules no cash policy and we can make no exceptions. She refuse to take my $70.00 cash deposit which was legal money, but would take a check which could have bounced all over Colorado and the information could have been bogus. You are so scared of money laundering that you are scaring yourselves out of business. I worked in banking for 19 years and we had a limit set on how much cash deposits could be taken due to money laundering.

I think that manager could have made an executive decision she knew $70.00 was not money laundering. I informed my sister of the incident and made a suggestion that she should close her account with Wells Fargo Bank immediately. Please understand my anxiety and there are others who think the way I do especially you older generation who are the ones with the money. Turning off your card is not a replacement for reporting your card lost or stolen.

Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account.

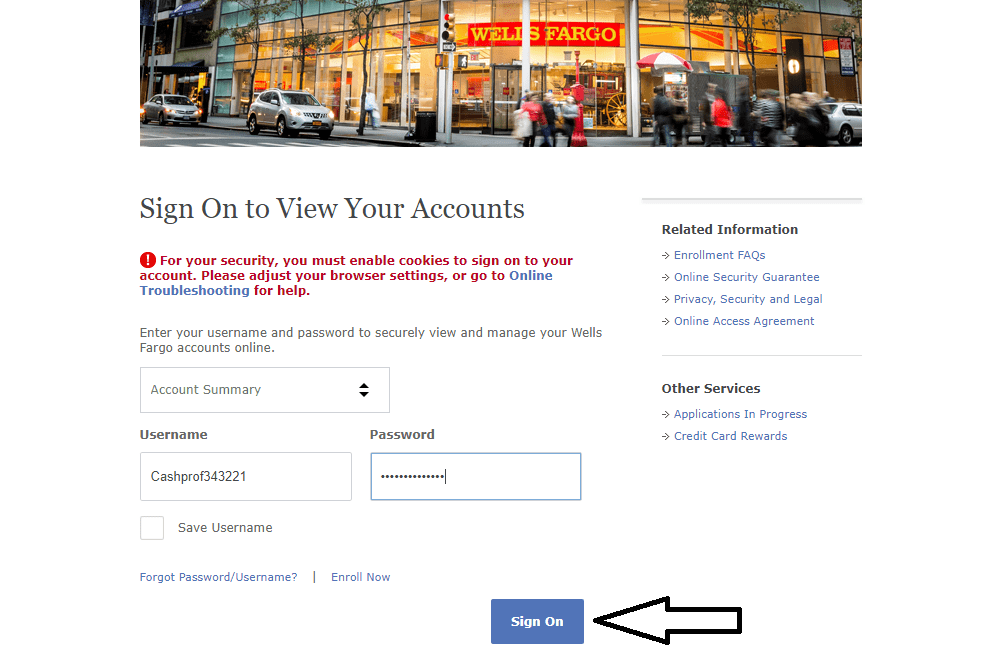

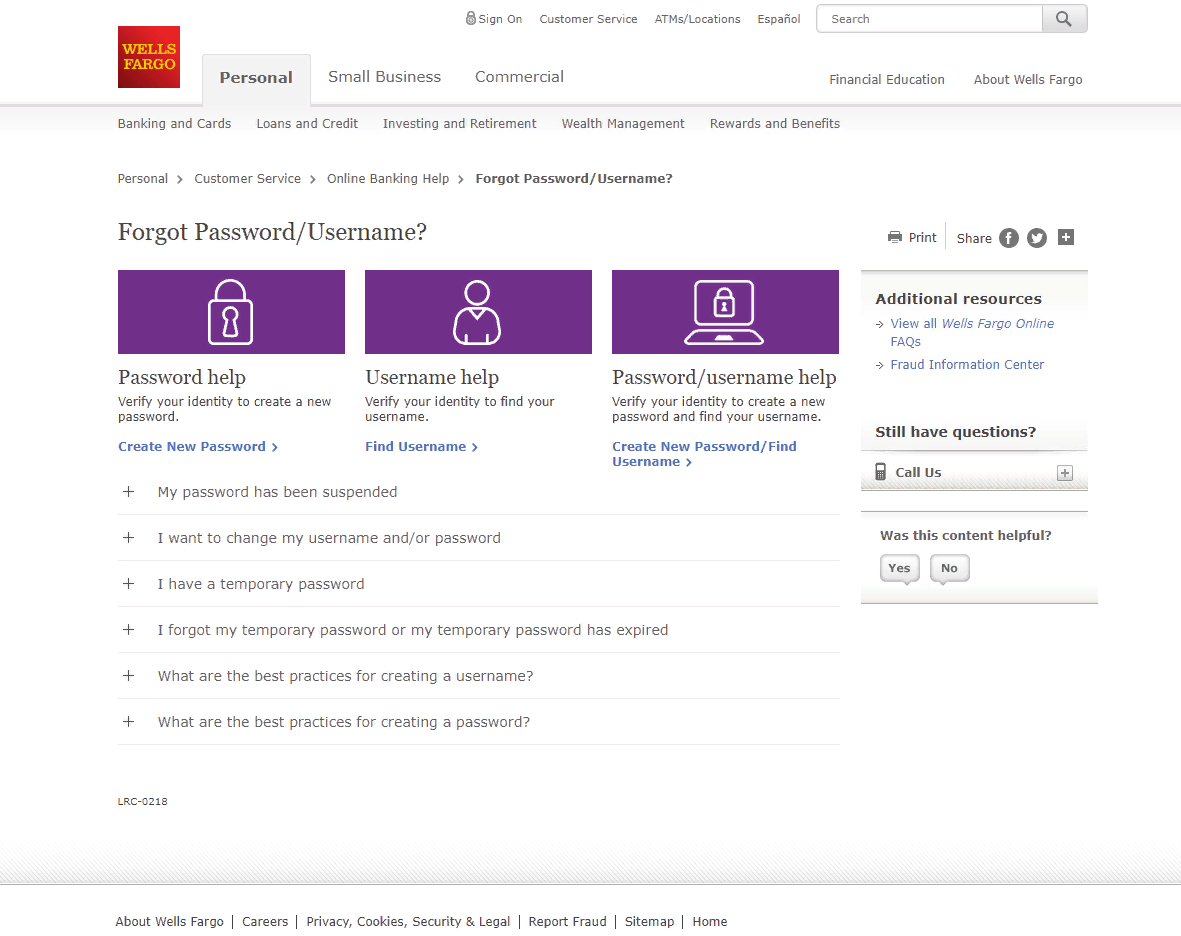

Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's messaging and data rates may apply. Sign on to manage online account access information.

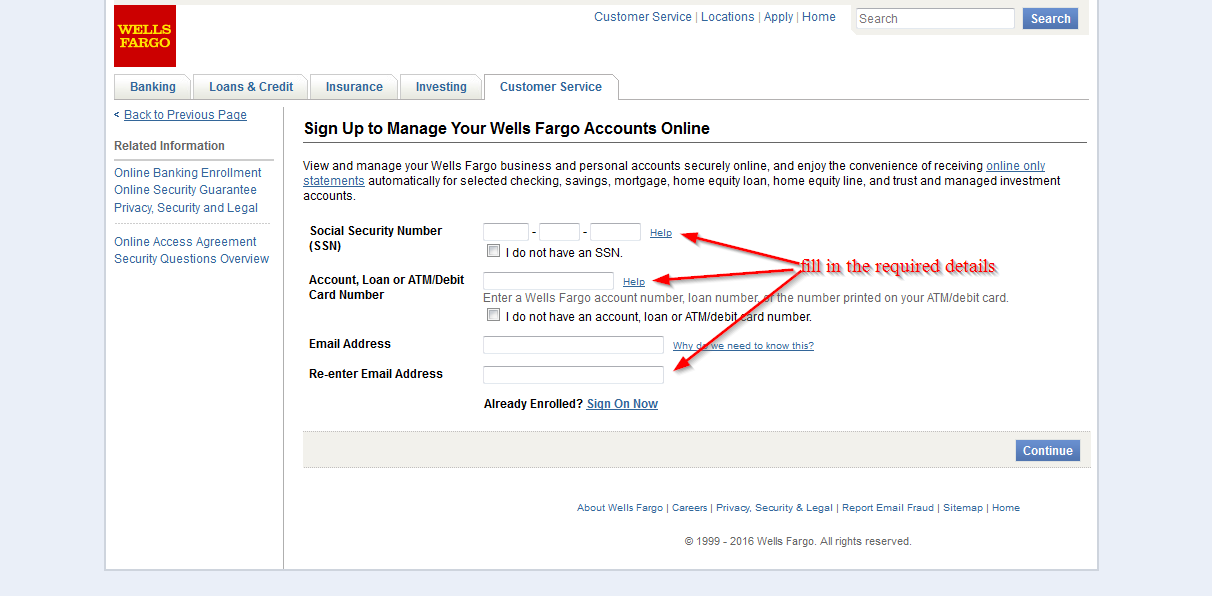

Eligible personal and business accounts include checking and savings, credit card, mortgage, home equity accounts, personal loans and lines of credit, commercial loans, business lines of credit, auto loans, student loans, brokerage, IRAs, and CDs . Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app.

To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone. For more information, view the Wells Fargo Wire Transfers Terms and Conditions. Wells Fargo offers many options to handle your financial needs, including checking and savings accounts, credit cards, investments and loans. Compared to other banks, interest rates and fees are average. Overall, Wells Fargo's products and services are robust and allow you the convenience to bank however and wherever you like.

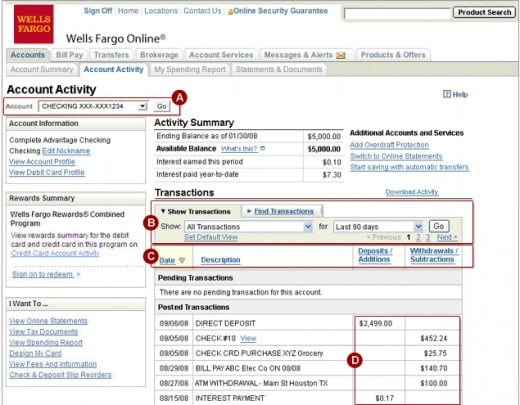

I had a checking account with large deposits during a certain time of year, the first 6 months of the year and my balance was over 3,000 monthly. I used my account mostly to pay monthly bills and ATM cash withdrawals. In July 2016 my account was overdrawn an I knew it should not have been and upon further inspection of my account there were several unauthorized charges made but my account was still not what I knew my balance should have been. In August I received a notice from a company that I did business with advising that my account information attached to my debit card was compromised and it went back for over a year before the company realized that customer info was breached.

Yes, Wells Fargo has 24/7 customer service available by phone and online.Is Wells Fargo a commercial bank? Yes, Wells Fargo provides commercial banking services and products for individuals and businesses.What states have Wells Fargo banks? Wells Fargo's dealer services provide indirect auto financing, commercial products and banking services to auto dealers.How old do you have to be to open a bank account at Wells Fargo? You can open a Wells Fargo account with a parent or guardian at 13 years old. You must be at least 18 years old to open an account on your own.

Wells Fargo offers a dedicated customer service center that is specifically for business banking customers. Customer service is available for general banking questions Monday–Saturday, 7 a.m. Customer service for online banking and bill pay is available 24 hours a day at a separate phone line. I contacted Randy Smith immediately and left him a detailed message of my concerns.